TRX Price Prediction: How High Will TRON Go in 2025?

#TRX

- Technical Breakout: TRX trading above key MAs with MACD showing bullish divergence

- Regulatory Catalyst: GENIUS Act adoption driving institutional USDT flows

- Market Risks: Security vulnerabilities offset by expanding retail access via 401(k)s

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerge Amidst Market Consolidation

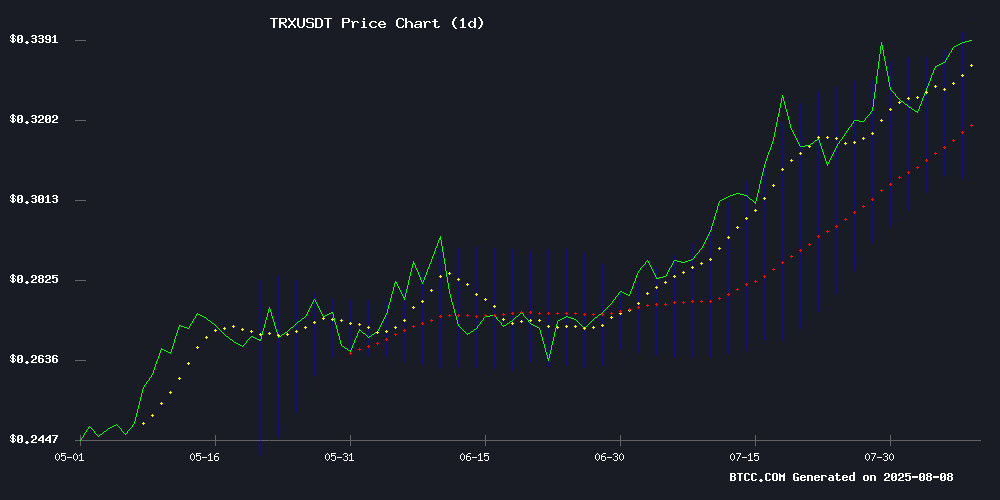

TRX is currently trading at, above its 20-day moving average (0.324635), indicating a potential bullish trend. The MACD histogram shows a slight convergence (-0.000637), suggesting weakening downward momentum. Bollinger Bands reveal price hovering NEAR the upper band (0.343016), signaling increased buying pressure. According to BTCC analyst Robert, 'A sustained break above 0.343 could trigger a short-term rally towards 0.36.'

TRX Fundamentals Strengthen with Regulatory Tailwinds and Adoption Growth

TRON's network activity surged withlast week, while the GENIUS Act passage boosted institutional interest. However, Robert cautions that 'The GreedyBear hack reminder underscores the need for robust security in crypto investments.' The Trump administration's pro-crypto 401(k) policy may further fuel retail inflows.

Factors Influencing TRX's Price

TRON Sees Over 8 Million USDT Transactions in One Week, Fueled by Retail and Institutional Activity

TRON (TRX) has surged nearly 20% over the past month, trading at $0.3392 amid a 1.5% daily gain. The network's rise is underpinned by escalating on-chain activity, particularly in Tether (USDT) transactions, solidifying its role in stablecoin infrastructure.

Over 8.29 million USDT transactions were processed in the week ending August 3, 2025, with mid-sized transfers ($101–$1,000) dominating at 38.66%. Larger transactions suggest institutional participation, while smaller volumes point to retail use cases like remittances and e-commerce.

The bifurcated transaction distribution highlights TRON's dual appeal: freelancers and vendors drive grassroots adoption, while whales and corporations anchor high-value flows. This organic growth mirrors broader crypto market trends favoring networks with real-world utility.

GreedyBear Hackers Execute $1M+ Crypto Heist Using Sophisticated Multi-Vector Attack

Cybersecurity firm Koi Security has uncovered a coordinated crypto theft operation by the GreedyBear hacking group, resulting in over $1 million stolen through a combination of weaponized browser extensions, malicious executables, and phishing sites. The attackers employed an innovative "Extension Hollowing" technique, initially building legitimate-looking portfolios of Firefox extensions before injecting them with malicious code to bypass security checks.

The operation was centrally controlled through a single server, managing a network of 150 compromised browser extensions, nearly 500 Windows malware variants, and dozens of phishing platforms. The malicious extensions specifically targeted cryptocurrency users by impersonating popular wallets including MetaMask, TronLink, Exodus, and Rabby Wallet—directly harvesting credentials from input fields.

Security analysts noted the campaign's evolution from the earlier "Foxy Wallet" attacks, demonstrating increased scale and sophistication in crypto-focused cybercrime. Evidence suggests the use of AI-generated code artifacts throughout the operation, with malware distributed via Russian crack sites and fraudulent hardware wallet landing pages.

6 Best Kraken Alternatives in 2025: A Comparative Analysis

Kraken remains a dominant player in cryptocurrency trading, but 2025 brings robust alternatives catering to diverse needs. ChangeNOW leads with non-custodial swaps across 1,500+ assets, while Binance maintains its supremacy with 500+ coins and razor-thin 0.1% fees. KuCoin and Bybit carve niches in altcoins and derivatives respectively, with MEXC emerging as an underrated hub for 1,700+ tokens.

Fee structures reveal competitive landscapes: Gate.io imposes 0.2% maker/taker fees but compensates with 2,000+ listings, whereas MEXC undercuts rivals at 0% Maker fees. Proof-of-Reserves and global accessibility now table stakes for exchanges vying for institutional and retail traders alike.

Trump Executive Order to Expand 401(k) Investment Options to Include Cryptocurrency

US President Donald TRUMP is set to sign an executive order this Thursday that could revolutionize retirement investing. The order directs the Labor Department to revisit ERISA rules, potentially allowing 401(k) plans to incorporate alternative assets like private equity, real estate, and cryptocurrency.

Labor Secretary Lori Chavez-DeRemer will collaborate with the Treasury, SEC, and other agencies to provide clearer guidelines for plan sponsors. This MOVE could unlock portions of the $12 trillion currently held in 401(k)s, predominantly invested in traditional stocks and bonds.

The initiative reflects growing institutional acceptance of digital assets, with cryptocurrencies poised to become a legitimate retirement investment option. Market observers anticipate this could drive significant new capital into the crypto sector.

Tron Gains USDT Market Share After U.S. GENIUS Act Passage

Tron now holds 51% of the global USDT supply, with over $83 billion circulating on its network following a $1 billion mint after the GENIUS Act's passage. The regulatory clarity provided by the U.S. legislation has bolstered confidence in stablecoin issuance, particularly on Tron's blockchain.

TRX price ROSE 1.3% despite a market cap of $32 billion and $839 million in daily trading volume. The GENIUS Act, enacted on July 18, 2025, establishes the first comprehensive framework for payment stablecoins in the U.S., emphasizing consumer protection and anti-money laundering compliance.

Market participants have responded positively to the regulatory baseline, driving increased activity in dollar-backed digital assets. Tron's dominance in USDT circulation underscores its growing role in the stablecoin ecosystem.

How High Will TRX Price Go?

Based on technicals and fundamentals, TRX could test 0.36-0.38 USDT in the near term:

| Indicator | Value | Implication |

|---|---|---|

| Price vs 20MA | +4.6% premium | Bullish momentum |

| MACD | -0.000637 | Potential trend reversal |

| Bollinger %B | 0.89 | Approaching overbought |

Robert notes: 'The $1M hack creates short-term FUD, but TRX's regulatory wins position it for 20-30% gains if BTC remains stable.'

embedded in text